The Life-Energization Reciprocity (LER) Process was at play in the preceding Entry and is also at play here as well. It provides the basis for the conversions of Arbeit and Geld. Recall earlier that the LER Process is derived from the Work-Standard’s Reciprocal Theory of Value (RTV) and Work Theory of Money (WTM). RTV provides the basis to identify and determine the Value of a given source of Arbeit. This Arbeit emerges from the creation of goods and the rendering of services. WTM is what allows anyone to provide a Price for those same goods and services in terms of Geld. With RTV, we can deduce that a given Enterprise in the VCS Economy has two sources of Actual Arbeit and one source of Actual Geld:

- Completed creation of a Product or rendering of a Service

- Successfully Selling it to the Tournament

- The Transactional Sales themselves

The two sources of Actual Arbeit yield “Arbeit-into-Geld,” while the sole source of Actual Geld is “Geld-into-Arbeit.” The first source is related to the LER Process, where the creation of a product or rendering of service required someone devoting Life-Energy to create Actual Arbeit that was later converted into Actual Geld at the Life-Energy Reserve. The second source of Arbeit stems from arranging a transactional sale in the Tournament that later resulted in a transfer of Actual Geld from the buyer to the seller. This single source of Actual Geld was Geld-into-Arbeit occurred because the Enterprise that received the Actual Geld from the transactional sale could spend that Actual Geld to repeat the LER Process. Given budgeting and taxation policies exclusive to the Work-Standard, a single Enterprise could immediately restart the LER Process without having to receive any excessive interference from Central Planners or their subordinates, the Economic Planners and their retinue of Accountants.

WTM builds upon the aforementioned conclusions from RTV by enabling everyone involved in the production process to distinguish between different goods and services based on their Value of Arbeit and the Price of Geld. We can then discern that the goods or services provided by one Enterprise are more valuable and expensive than another Enterprise from the same Industry because the Quality of Arbeit for its production process was superior to that other Enterprise. Conversely, we can also argue that because the Quality of Arbeit for the other Enterprise was inferior to the first one, the Price of its goods or services had to be lowered as a consequence.

- Completed Creating the Finished Product → Actual Arbeit → Actual Geld (Arbeit-into-Geld)

- Successfully Selling it to the Tournament → Actual Arbeit → Actual Geld (Arbeit-into-Geld)

- The Transactional Sales themselves → Actual Geld (Geld-into-Arbeit)

parameters of Arbeit and Geld creation

The Central Bank’s Life-Energy Reserve

Before the process of converting Arbeit into Geld can begin, the Central Bank will note the overall “Quality of Arbeit (QW)” of the Vocational Civil Service (VCS) Economy. The QW is the total Value of the Arbeit from all Vocations. It is affected by the overall “Work-Intensity (WI)” and “Work-Productivity (WP)” as well as all known “Force Multipliers (FMs)” at any given Zeit. Shorter intervals of Zeit with “High WI, High WP” or “Low WI, High WP” will decrease the Quality of Arbeit by a rising Attrition Rate. Longer intervals of Zeit with “High WI, Low WP” or “Low WI, Low WP” are more likely to increase Quality of Arbeit through the Inaction Rate.

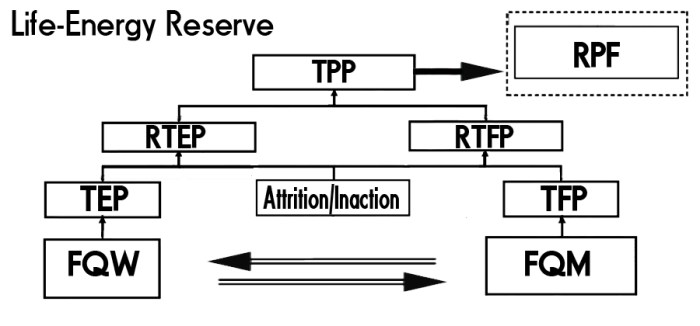

The Central Bank gauges the nation-state’s Quality of Arbeit through the “Total Economic Potential” (TEP), the Work-Standard’s alternative to the Gross Domestic Product. TEP is the final sum of all economic and financial activities by the nation-state before its Attrition/Inaction Rate was factored. For finding the TEP after Attrition/Inaction, the Central Bank uses the “Real Total Economic Potential” (RTEP). RTEP affects how much Geld is allowed to be created by the Central Bank and is influenced by the Quality of Arbeit. It is tenable to argue that RTEP represents the Quality of Arbeit applicable to all Vocations within the VCS Economy.

Given the Quality of Arbeit and the Real Total Economic Potential in relation to the Attrition/Inaction Rate, the Central Bank can now determine the “Quality of Geld (QM).” The QM refers to the Price for any conversions of Arbeit into Geld under the Work-Standard. It affects how much Geld can be printed by the Central Bank based on a specified amount of Arbeit. A nation-state having a “High QW” can be correlated to them having a “Low QM.” This means that they are able to command a superior Quality of Arbeit that enables them to create more Geld with fewer amounts of Arbeit. Conversely, a “Low QW” can be correlated to them having a “High QM.” Under those conditions, the nation-state has an inferior Quality of Arbeit that forces them to spend more Arbeit for less amounts of Geld.

It is because of the need to factor how QW and RTEP affect the QM that the Central Bank must find the “Total Financial Potential (TFP).” A TFP is the sum of all Geld that has already been converted from Arbeit before including the Attrition/Inaction Rate. If the Central Bank needs to know the TFP with the Attrition/Inaction Rate, they will use the “Real Total Financial Potential (RTFP).” RTFP is the final sum of all Geld in circulation and is limited by the RTEP. Remember that the Attrition/Inaction Rate is not affected by the RTFP but by the RTEP because of the nature of the Work-Standard. If the Central Bank needs to print more Geld, the RTEP will need to be gradually increased to facilitate it.

What happens if the Central Bank decides to print more Geld to increase the RTFP without any expected increases in RTEP? That Geld is counted as Schuld and is thus added to the Sovereign Schuld of the nation-state as “unpaid debts.” This is done to discourage excessive creations of Geld and deter the existence of Schuld-backed Kapital under the Work-Standard. As a Constitutional Obligation with a corresponding Constitutional Intent, any Sovereign Schuld must be paid back without any Interest whatsoever under the Work-Standard.

For the sake of review, six variables are accounted for in the conversion of Arbeit into Geld. It is understandable for someone to ask where these variables fit within the bigger picture of the Work-Standard in relation to the Financial Regime. The following table demonstrates where the variables coexist with the Attrition/Inaction Rate, the TPP (Total Productive Potential) and the RPF (Requisitionary Productive Forces):

The QW, TEP and RTEP correspond with the economic; the QM, TFP, and RTFP are related to the Financial. What happens in the VCS Economy must affect what is referred to elsewhere as the “Reciprocal-Reserve Banking System” and what affects it must in turn affect the VCS Economy. That is where the Work-Standard prevails in contrast to the Liberal Capitalist conceptions of Kapital. With Kapital, it is possible to argue that the Financial Markets are an economy onto themselves, independent of what the national economy is doing at any given Zeit.

Simply put, the Reciprocal-Reserve Banking System is the Financial Regime of the Council State as a triumvirate of the Head of State, the State Council, and the Central Bank. The Central Bank in particular can readjust the Quality of Arbeit through a “Mechanization Rate (MR).” The Mechanization Rate is the Work-Standard’s alternative to the Interest Rate by focusing more on how much Arbeit is being created by actual Vocations and how much has been allowed to be created by automated technologies. The MR is capable of increasing the RTEP and improve the QW without causing serious increases in Attrition by conserving the Life-Energy of Vocations. It may seem counterintuitive, but the MR has its purposes and should never be seen as an excuse to replace Vocations with machines.

Supporting the endeavors of the Central Bank are various “State Banks” and “National-Socialized Banks (NSBs).” The former facilitates the transmission of Arbeit and Geld between the Economic Planners of a given Enterprise and the Central Bank’s Life-Energy Reserve, in addition to maintaining the personal accounts of the Totality and those of the Enterprises. The NSBs are conventional banks capable of providing special Interest-free loans backed by the Work-Standard.

Aside from those two types of banks are the “Kontore (Financial Offices)” and the “State Commissariats for Wages and Prices.” The Kontore are tasked with helping Professions, Enterprises and Central Planners facilitate economic planning. Through the issuances of distinct financial instruments under the Work-Standard, the role of Central Planners will change from one that dictates what is to be done to one where they are tasked with interpreting the central plan and how it is applicable to various economic plans designed to realize the central plan. The State Commissariats, as their implies, is given the role of determining the pricing of everyday goods and services in the VCS Economy’s Tournament and how much the Totality is expected to receive each week as their Paygrade.

Categories: Compendium

Leave a comment