The simple mathematical equation associated with Double-Entry Account Bookkeeping is designed to allow an Accountant and their assistant, a “Bookkeeper,” to create documents describing the movements of Kapital and Schuld between different entities. The Bookkeeper compiles the documentation for the Accountant to present to the managerial, financial or administrative personnel in charge. The Accountant can then demonstrate how a given Quantity of Kapital was transferred to another person or group for a predetermined set of goods or services. They can even show the Quantity of Schuld that accumulated over a particular period.

Given that Assets are the sum of Liabilities and Equities, it then follows that they will try to organize a “T-Chart,” depicting how Kapital and Schuld changed hands. As its name implies, this T-Chart is designed to show how a particular entity, such as a governmental organization or a privatized commercial firm, gained or lost Kapital and Schuld. It does not specifically describe why that entity gained or lost Kapital and Schuld nor does it outline the circumstances in which it occurred. After all, the purpose of the T-Chart is to provide a basic frame of reference for Accountants and Bookkeepers to document the movements of Kapital and Schuld as they occur.

Although it will be made clearer in subsequent Entries throughout Section One, the T-Chart is designed to arrange the movements of Kapital and Schuld, providing relevant information for the “Chart of Accounts (CoA)” of the affected organization.

What can be said here about the descriptions of Kapital and Schuld changing hands is how they are meant to be categorized. One category depicts the increase or decrease in the Value of the Assets, another category showing the increase or decrease of the Liabilities, and a third featuring the increase of decrease of the Equities. Any Revenues and Expenses also have their own T-Charts.

It should be noted that decreases to the Assets and Expenses are always recorded as “Credits,” while any increases are listed as “Debits.” Conversely, any increases to the Liabilities, Revenues, and Equities are denoted as “Credits,” whereas their decreases are marked as “Debits.” Someone unfamiliar with basic accounting may find that such arrangements are a bit misleading, if not outright confusing. Those arrangements represent specific changes to the Quantities of Kapital and Schuld, hence this Author’s emphasis on the purpose of Double-Entry Account Bookkeeping being to record the movements of Kapital and Schuld between different entities.

But should find trouble distinguishing these categories, especially regarding the “Chart of Accounts (CoA)” that will be discussed in a subsequent Entry, consider the following:

- Assets → Gain Schuld (Debit) and Lose Kapital (Credit)

- Expenses → Gain Schuld (Debit) and Lose Kapital (Credit)

- Liabilities → Lose Schuld (Debit) and Gain Kapital (Credit)

- Revenues → Lose Schuld (Debit) and Gain Kapital (Credit)

- Equities → Lose Schuld (Debit) and Gain Kapital (Credit)

Remember, every aspect of economic life in Neoliberalism always revolves around a simple transfer of Kapital and Schuld for a set amount of goods or services. When an Accountant or Bookkeeper outlines their T-Charts, they are describing how Kapital and Schuld are gain and lost from overall economic activities. At the same time, they are also documenting how existing Kapital and Schuld gained or lost Value from the effects of Currency Depreciation. Currency Depreciation, to recall what was discussed previously in The Work-Standard (3rd Ed.), is the result of a Currency (which is always a Fiat Currency after the Death of Bretton Woods) losing its Value due to increases in the Inflation/Deflation Rate. Changes to the Values of Kapital and Schuld need to be accounted for because their Values are not guaranteed to be static, thereby necessitating the need for the Chart of Accounts (CoA) to be derived from two sets of ‘books’, one serving as a rough draft, the other as a final draft.

Over the course of this Treatise, the term “Financial Ledger” will be used in reference to the technical term “General Ledger” found in the Accounting Profession. Note that the former and the latter terms are to be understood to mean the same thing. Where the distinctions do begin is in connection to the “General Journal,” which is an entirely different document separate from the Financial Ledger. For the purposes of illustrating Double-Entry Account Bookkeeping and its proposed Work-Standard equivalent, this term will be hitherto referred to as the “Daybook Journal.” The term fits due to the manner it was oftentimes formatted.

Prior to the rise of accounting software developed since the Death of Bretton Woods in the 1970s, Accountants and their fellow Bookkeepers would keep a Daybook Journal and a Financial Ledger. The Daybook Journal would contain information pertaining to the movements of Kapital and Schuld between persons, groups, and firms. Its entries also included notations on discovered accounting errors, documentation pertaining to “Receipts” and “Invoices” as well as the inventory of items and the possible Currency Depreciation affecting those items. A suitable analogy would be to envisage the Daybook Journal as a sort of draft copy of what can later be found in the Financial Ledger. This draft copy would then be used to verify and make further corrections on the listed entries before recording them in the Financial Ledger.

Most Daybook Journals are followed in the following manner:

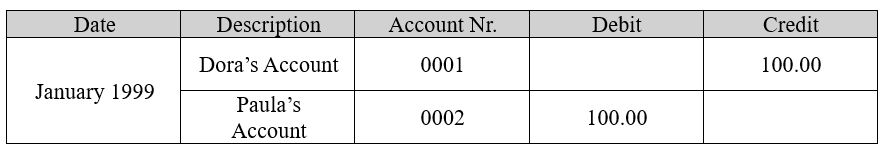

Recall earlier that the T-Chart is used to record the movements of Kapital and Schuld as they occur. Since the T-Chart on its own cannot document the circumstances in which those movements took place, the Daybook Journal is used to provide the corresponding event chronology and context. For an average transactional sale, the date and time of the event is recorded, followed by a description of what occurred, an assigned Account Number, and then the transferring of Kapital and Schuld between two Accounts. Consider the following transaction below:

The above example states that, in January 1999, an account owned by Dora received $100.00 USD from another account owned by Paula. Paula had sent $100.00 USD to Dora within the same privatized commercial bank and under the same Fractional-Reserve Banking System of a given Liberal Capitalist Parliamentary Democracy. From the perspective of the Accountant and Bookkeeper, they would document two specific events that happened in January 1999:

- Paula (Account Nr. 0001) gave $100 USD to Dora (Account Nr. 0002)

- Dora (Account Nr. 0002) received $100 USD from Paula (Account Nr. 0001)

Because $100 USD was given and $100 USD was received, the Debit and Credit are supposed to be equal. In fact, every transaction that takes place under Double-Entry Account Bookkeeping needs to have its Debits equal to its Credits. Since the existing Kapital got transferred from one account to another account, there was no need to create any new Schuld. But what would happen if such an event were to occur? The significance will be made apparent in a later Entry pertaining to “Receipts” and “Invoices.”

Categories: Work-Standard Accounting Practices

Leave a comment