As established in the preceding Entries, the Kapital and Schuld tracked by Accountants and Bookkeepers in Double-Entry Account Bookkeeping have substantiated existences. There is Kapital being earned and spent as well as Schuld being incurred and reduced over the course of a given period. The Kapital and their associated Schuld can then be easily monitored, collected, and recorded as they move between accounts owned by different people. Any corrections to the Quantity of Kapital and the Quantity of Schuld will need to be addressed before presenting them in the final drafts of the official financial documents.

However, there are moments where the Kapital and Schuld are difficult to track down and alterations that need to be made to reflect this. To reflect the unsubstantiated and unverifiable, the terms “Accounts Uncollectible” and “Contra Accounts” are chosen to refer to circumstances involving Kapital and Schuld that are either unaccounted for or can be deducted.

Accounts Uncollectible and Doubtful Accounts

Recall in an earlier Entry how, in January 1999, Paula paid Dora $100.00 USD for a set number of items from her as part of a transactional sale. What would happen if Paula owed Dora $20.00 USD from another transactional sale? How would an Accountant and Bookkeeper record it?

Typically, an “Accounts Uncollectible” emerges whenever a Lender has lent Kapital to a Borrower, whose Schuld has yet to be paid back with more Kapital. Since the Lender expects the Borrower to use the already existing Kapital to create more Kapital, it falls upon the Incentives of the Borrower to figure out how they intend to pay down their newfound Schuld. But because the Borrower will not always be able to pay back their Schuld with an external influx of Kapital, an Accounts Uncollectible is introduced to record whatever Schuld the Borrower owes to the Lender.

Borrowing and lending are not the only contexts in which an “Accounts Uncollectible” becomes relevant. Another occurrence involves someone, like Paula, issuing an Invoice to Dora as part of another transactional sale in February 1999. Normally, when a transactional sale occurs where an Invoice is issued, a certain timeframe is established for when it counts as Kapital and when it becomes Schuld to be collected. While some privatized commercial firms maintain their own timetables, most tend to wait anywhere between thirty (30) and ninety (90) days before listing the transactional sale under the Accounts Uncollectible.

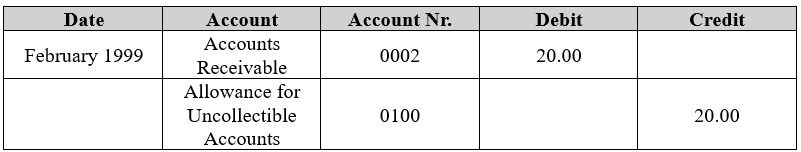

Once that timeframe has been exceeded, the Bookkeeper and Accountant would mark the Quantity of Schuld under the Accounts Receivable as a Debit and then establish a “Doubtful Account” under Credit with the same amount. The former entry indicates a Quantity of Schuld that has yet to be accounted for, whereas the latter entry is a Quantity of Kapital that has yet to be paid. If the Borrower fails to pay back the Lender, then the Bookkeeper and Accountant must make the proper adjustments. The Borrower will not pay back the Schuld with Kapital, forcing the Lender to pay it themselves with their own Kapital to restore the balance between Kapital and Schuld.

Moreover, it is possible for a Lender to let the Schuld from their Accounts Uncollectible to ‘age’, to remain unpaid for, hence an “Aged Receivable.” They represent Schuld that people like Paula have failed to pay back with Kapital and can always be paid by Dora. If Dora pays the Schuld herself, then the Accountant will make the proper adjustments with the Bookkeeper’s assistance.

To restore the balance between the Quantity of Kapital and Quantity of Schuld, the Accountant will note the changes in an “Unadjusted Trial Balance.” Next, the Accountant would subtract the Schuld for the already existing Kapital under Assets to reflect the failure of the Borrower to pay back the Lender. The revisions are then referred to as the “Adjusted Trial Balance.”

When the moment comes to report the changes in the official financial documents, the Accountant would note the adjustments under Assets and Equities, leaving the Liabilities unchanged. In the basic mathematical equation of Assets as the sum of Liabilities and Assets, the Accountant would mark the changes under Assets (as Accounts Receivable) and Equities (as a “Bad Debt” or “Bad Schuld” Expense). The Schuld deducts Kapital from the Assets and the Kapital within the Equities. In the context of Paula paying back the Schuld created by Dora, only $20.00 USD is lost from Dora failing to pay and Paula being forced to pay it herself. The “Bad Schuld” is in turn recorded as one of the Expenses associated with Paula’s economic activities.

Contra Accounts

It should be noted that the concept of a “Bad Schuld Expense” is one among many examples of “Contra Accounts” that are tracked in Double-Entry Account Bookkeeping. The term refers to economic activities where Kapital was lost due to Schuld or where balance between Kapital and Schuld remained unchanged. They are always identified as Expenses which affect either the Assets, Liabilities, Equities or Revenues. The first is identified as a Credit, the other as Debits.

- The “Contra Asset” reports Kapital lost due to the accumulation of Bad Schuld or Depreciation due to Currency Depreciation.

- The “Contra Liability” are not common because they reflect “Amortizations” where less Kapital is needed to pay back other types of Schuld.

- The “Contra Equity” affect Schuld incurred from the divestment of Kapital.

- The “Contra Revenue” entail surplus Kapital that came from having to spend less of it due to “Sales Discounts” or “Sales Returns.”

The purpose of the Contra Accounts is to provide Accountants with a way of making the entries easier to organize and cleaner for others. Everyone wants to know where and how Kapital was lost or how Schuld was lost and allowed more Kapital to come into existence. They also want to know when those events occurred to develop a comprehensive picture of their finances.

Categories: Work-Standard Accounting Practices

Leave a comment