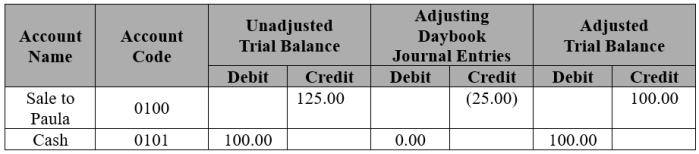

Remember those two charts I spoke in the latest Entry of Work-Standard Accounting Practices, Trial Balances in Double-Entry Account Bookkeeping?

Note the amounts listed on the Adjusted Trial Balances on the far-right columns of both charts. They depict how Dora earned $100.00 USD from Paula spending $100.00 USD on items whose Value is also $100.00 USD. Has one ever wondered why they have to arranged in that particular matter?

The reason why is because Dora’s transactional sale of items to Paula resulted in a loss of $100.00 USD worth of “Inventory,” which Double-Entry Account Bookkeeping always records as Assets. While there is a Work-Standard equivalent for Inventory, for the same reason why there will need to be a “Trial Balance,” it is necessary to understand how the concept applies to in Double-Entry Account Bookkeeping. At the same time, how Dora spent her own Kapital to purchase the materials needed to produce the finished goods that she would later sell to Paula.

The Entry “Inventories and Accounts Receivable/Payable” is the next Entry to be written for Section One of Work-Standard Accounting Practices. I am still discerning on whether this should be a one-part or two-part Entry. My decision will be finalized by the end of the weekend because the goal is to get this Entry, either as a one-part or a two-part, finished before the end of tomorrow.

Categories: Uncategorized

Leave a comment