In The Work-Standard (3rd Ed.) and again in The Third Place (1st Ed.), it was stipulated that the Market/Mixed Economy, like the rest of the Liberal Capitalist Nation, operate under two Modes of Production. Those Modes of Production were called “Production for Profit” and Production for Utility.” In Production for Profit, the value-judgments of economic activities revolve around whether they yield more Kapital (profitable) or less Kapital (unprofitable), their “Exchange-Value.” In Production for Utility, those economic activities are instead based on the perceived Utility (usefulness) or the lack thereof (uselessness), their “Use-Value.”

The Market/Mixed Economies of most Liberal Capitalist Parliamentary Democracies employ some combination both Production for Profit and Production for Utility. Certain countries will exhibit greater emphasis on Production for Profit, whereas others prefer Production for Utility. Social-Democracies tend to employ a delicate balance between the two Modes of Production due to their inherent nature from the genuine Scientific or Artistic Socialisms. Such arrangements arose in response to the developments of the 19th and 20th century, arriving at their contemporary forms during the two World Wars and the Great Depression. Even the ‘freest’ of the so-called ‘Free Markets’ in those Civil Societies are not exempt from this trend.

In economic life, the delineation between the two Modes of Production entails certain economic activities being done by Parliament (“Public Sector”) and others by the Market/Mixed Economy (“Private Sector”). Some prominent examples of Production for Utility may include:

- Highways, Railways, Seaports and Airports

- Bridges, Dams, Canals and Levees

- Mass Transportation Systems

- Electric generators and power lines

- Water, Fuel and Sanitation systems

- Hospitals, Schools and Universities

- Parks, Housing, and Telecommunications

Unlike most economic activities, which tend to operate predominantly in Production for Profit, those aforementioned economic activities are oftentimes found operating in Production for Utility. They share that Mode of Production with Non-Profits Organizations, Philanthropies and Charities, Special Interest Groups and Think Tanks, and Government Contractors and Vendors.

The complexities disappear in Double-Entry Account Bookkeeping because Production for Profit and Production for Utility still involve the movements of Kapital and Schuld. Like Parliament, Economic Organizations also maintain their own budgets, funds, and accounts. Their movements of Kapital and Schuld throughout the Liberal Capitalist Nation or across international borders are facilitated by two specific entries in Double-Entry Account Bookkeeping: the “Accounts Receivable” and “Accounts Payable.” Some will even maintain an “Inventory” required for production processes and transactional sales, all of which must be recorded.

For the sake of simplicity, and because a more appropriate version of it exists under the Work-Standard, the term will be referred to as “Accounts Receivable/Payable” throughout this Entry and the rest of the Treatise. The concept essentially refers to the transferring of something by someone for something else held by another. While one could view the transfer in terms of Kapital and Schuld, one could just easily conceive another transfer in terms of Arbeit and Geld.

Accounts Receivable/Payable

Typically, in Double-Entry Account Bookkeeping, Accounts Receivable refers to the Quantity of Kapital or the Quantity of Schuld being received by a person or group. It is contrasted by the Accounts Payable, which is the Quantity of Kapital or the Quantity of Schuld that the same person or group is expected to pay back to another. The terms are used to denote how much Kapital or Schuld was transferred to the person or group in question, both of which are accompanied by the method chosen to facilitate their movements.

For most Economic Organizations in the Market/Mixed Economy, Accounts Receivable are usually recorded as a Debit to signify an increase in the Quantity of Kapital controlled by the affected Economic Organization. Conversely, the Accounts Payable are reported as a Credit, representing the Quantity of Schuld that the Economic Organization must pay back with Kapital as part of its Liabilities. This is because any influx or outflux of Kapital and Schuld under Accounts Receivable/Payable is going to affect the Assets controlled by the Economic Organization.

The following table was created to provide an easy frame of reference for understanding how Accounts Receivable/Payable are applied in Double-Entry Account Bookkeeping. The Asset Accounts belong to the Economic Organization, its Quantity of Kapital and the Value of everything stored in its Inventory. The Liabilities Accounts denote payments of Kapital owed to a person or group outside the Economic Organization, as well as payments of Kapital owed to its employees and Interest owed to the Fractional-Reserve Banking System. The Equities Accounts show the Quantity of Kapital invested into the Economic Organization, in addition to all Revenues and Expenses associated with its overall economic activities.

The formation of Accounts Receivable/Payable will always remain constant. Accounts Receivable will always be Debits, while Accounts Payable are Credits. Note the term Equipment/Inventory Account. Its placement among Assets is indicative of everything that an Economic Organization would need for its economic activities, such as production processes. The formal technical term is referred as “Property, Plant, and Equipment (PPE).” PPEs are generally anything that an Economic Organization, operating in Production for Profit or Production for Utility, owns as one of its “Long-Term Assets.” Land, buildings, vehicles, and machinery are notable examples of PPEs required for production processes within both Modes of Production.

It is also noteworthy that PPEs tend to depreciate or lose Value over time as they are being used in production processes and transactional sales. Older vehicles and machinery become less reliable and harder to replace as the costs of maintenance increase. Land and buildings require upkeep in order to them functional and ensure continued operations. Thus, the “Accumulated Depreciation” of their Values and the “Kapital Expenditures” to keep them maintained can be accounted for with the “Gross PPE” value to yield the “Net PPE.” The Net PPE can inform an Accountant or Bookkeeper the Values of PPEs owned by an Economic Organization, how much it spent to buy, upgrade, or maintain them, how much of its Value was lost over the course of its Service Life.

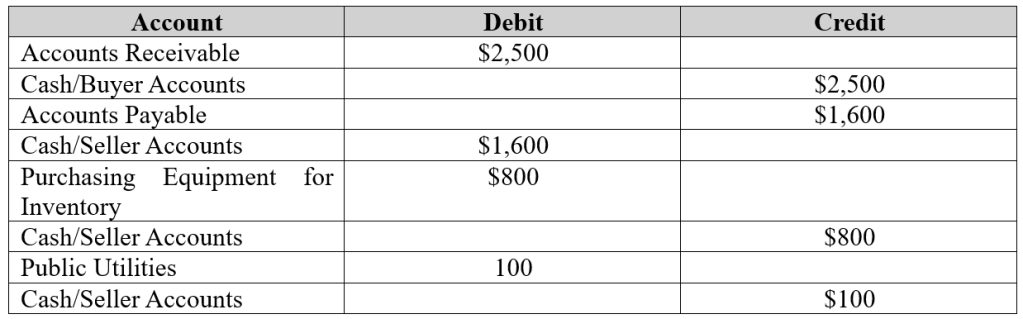

The next table will document two events affecting four separate pairs of accounts associated with an Economic Organization, including two pairs that are reserved for Accounts Receivable/Payable. One pair of accounts describes how $2,500 USD was recorded on Accounts Receivable due to an Economic Organization earning that same amount from its transactional sales. The second pair of accounts is an Accounts Payable of $1,600 USD that an Economic Organization paid as part of its Expenses. The third and fourth pairs outline how the Economic Organization spent $800 USD on acquiring new equipment and $100 on basic utilities (power, water, fuel, et al.) provided by Parliament. Assume that the Economic Organization had an Opening Balance of $0.00 USD and ended with a Closing Balance of $0.00 USD.

To demonstrate how Accounts Receivable/Payable operate, I will return to the January 1999 transactional sale between Dora and Paula, only this time in the days leading up to it in December 1998. Dora runs a Small Business that produces finished goods from raw materials and sells them to people like Paula in USD. Prior to that transactional sale, Dora had to have acquired the raw materials to manufacture the products that would later be sold to Paula a month later. The raw materials and the finished goods are considered Assets in Double-Entry Account Bookkeeping because they are owned by the Small Business and are associated with its economic activities.

An Accountant or Bookkeeper would devote a journal entry in the Daybook Journal that would later be finalized in another within the Financial Ledger. These entries are Asset Subaccounts pertaining to the Inventory of the Small Business. It would provide a description of what was purchased, what was produced, and their corresponding Values. Note that their Prices do not necessarily have to be equal to their Values in Production for Profit and Production for Utility.

The table below documents a series of economic activities that occurred throughout December 1999, one month prior to the transactional sale in January 1999. It describes how Dora spent $50 USD worth of raw materials, how the Value of those raw materials had remained constant throughout the production process and their subsequent storage.

Careful observation of that table will reveal two recurring variables, one of which only appears once: the “Inventory” and “Cost of Goods Sold (COGS).” The whole production process impacted the Inventory associated with Dora’s Small Business. The COGS is just an extension of that fact.

The Accountant and the Bookkeeper will need to account for the Value of the Inventory and how much it took to keep the Inventory stocked and ready for the next transactional sale. If not Schuld, then Kapital had to have been spent at some point to facilitate the production of goods and the rendering of services. At the same time, a specific methodology needed to be developed to track how much is available and left over the course of any given Accounting Period.

Inventory

The Inventory of an Economic Organization denotes the Values and Prices of raw materials required for the manufacturing of finished goods and the costs associated with having them in storage. Everything required for any production process needs to be procured from somewhere if the Economic Organization in question is not already creating the raw materials. This means accounting for the existing stocks, the “Beginning Inventory,” and where and how it is expanding their Inventory. An Economic Organization may produce what it needs for its production processes or it can purchase it from another on the Market/Mixed Economy. Whichever the case may be, there are two relevant equations that are used to account for the Inventory: the “Cost of Goods Available (COGAs)” and the “Cost of Goods Sold (COGS).”

The Cost of Goods Available (COGAs) refers to the Price of either purchasing or manufacturing goods required for specific production processes or transactional sales. It represents the sum of the Beginning Inventory and all purchases or production that had resulted in the former’s expansion.

The Cost of Goods Sold (COGS) becomes applicable to transactional sales. It describes how the Value of the Beginning Inventory, the Price of how much was required to maintain the Inventory, and the difference of what was left over after all transactional sales had occurred.

Both COGA and COGS presuppose that the Economic Organization is already familiar with what it has in its own storage areas. For there are two ways that an Economic Organization could take account of how much it is producing or purchasing as part of its production processes: “Periodic Inventory” and “Perpetual Inventory.” The two methods emerged as the result of post-1945 technological advancements in computerization and automation technologies related to the “Digital Realm.” Although the concept is obviously beyond the focus of this Treatise, I should mention that the Treatise, The Digital Realm (1st Ed.), goes into far greater detail there.

What can be said here is that the technologies in question concern the ability to track and monitor the stockpiling of products or raw materials for the Inventory. Everything discussed in this Entry thus far can be reapplied through technological means.

Periodic Inventory is the traditional way of recording an Inventory. An Economic Organization would employ someone at their warehouses or storage areas to go through the various products, raw materials, equipment, vehicles and so forth. They would count how many individual units are being stored with a predetermined Value and Price in mind. The Value and Price would have been provided to that person by the Accountant and their Bookkeeper.

Meanwhile, Perpetual Inventory reflects the newfound technical capability of using computer software and machinery at the same facilities. All facilities, including the warehouses, owned by the Economic Organization are connected to each other vis-à-vis the Digital Realm. Whether through a “Computer Network” or a “Computer Server,” the software in question enables everyone to obtain a real-time picture of the Inventory. Barring the risks of Malware and Cyberwarfare, an Economic Organization can find out exactly how much was produced, how much was purchased, how much was sold from the Inventory, and how much is left after all transactional sales.

Larger Enterprises will opt for Perpetual Inventory to offset the administrative and organizational hurdles of running operations throughout regions or nations. Smaller Enterprises by contrast will prefer sticking to Periodic Inventory because their Inventories are nowhere as massive as larger Enterprises and the costs of running the digital infrastructure far exceeds their own budgets.

Categories: Work-Standard Accounting Practices

Leave a comment