For this two-part Entry of Work-Standard Accounting Practices, we will be evaluating some aspects of Double-Entry Account Bookkeeping that are intimately related to Production for Profit/Utility. Given what was discussed about those two Modes of Production in The Third Place (1st Ed.), there are no contradictions between Production for Profit and Production for Utility. It has been the case since the Great Depression and the two World Wars during the 20th century.

Part I will begin by drawing from topics discussed in The Third Place (1st Ed.) to flesh out the concept of “Property, Plant, and Equipment (PPE).” It will discuss how privatized commercial firms are subject to Rents and Interest like the Private Citizen and the rest of Civil Society and its Market. This is followed up with a discussion of how privatized commercial firms determine the Profitability and Utility of their PPE and Inventory.

Moreover, Part II explores some notable examples of Liabilities and Equities that are relevant to Production for Profit/Utility. A lot of those concepts were addressed in various Entries throughout The Work-Standard (3rd Ed.) and, to a lesser extent, The Third Place (1st Ed.). Here, we will be understanding how they become applicable to Double-Entry Account Bookkeeping. I will also mention how they are not relevant to the Work-Standard.

Kapital Leases and Operating Leases

Unlike the Work-Standard, the Liberal Capitalist conception of Property is “Property-as-Wealth.” There is “Private Property-as-Wealth” and “Common Property-as-Wealth.” The latter was of course the point of origin for the term “Commonwealth” in the English language, a term that is tied to the legacy of the old British Empire. The concepts have become intertwined with Liberal Capitalist Political Philosophy that they have outlived their British Imperial origins. We begin to grasp the concepts by envisaging the following scenario.

Somewhere in the world, there is an undeveloped plot of land. Nobody is camping there, and nobody is constructing something there. The plot of land is considered Common Property-as-Wealth until somebody or more specifically something, like a privatized commercial bank or a real estate developer, acquires the land. That land becomes their Private Property-as-Wealth. They allowed construction crews to go in, establish infrastructure and construct buildings.

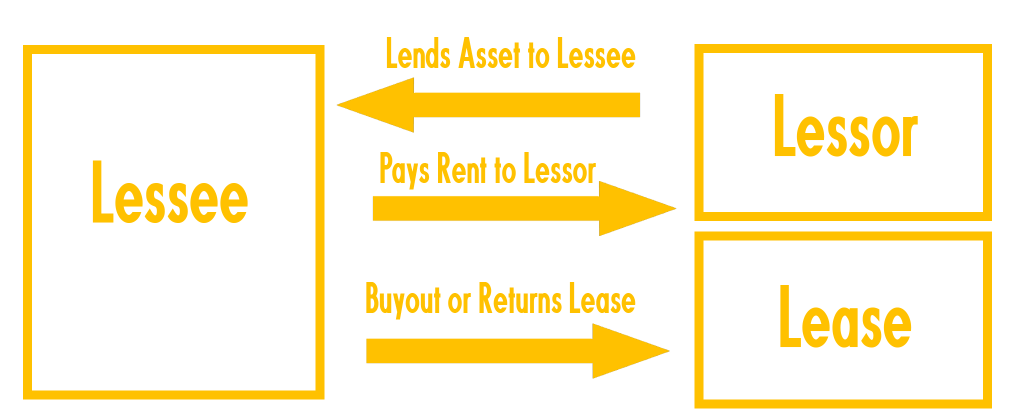

Once everything was set up, they become a “Lessor” by proceeding to offer “Leases” to a “Lessee,” which is whoever may be interested in using the buildings and the land. Note that the relationship is just another variation of the Lender and the Borrower for a Loan from the Fractional-Reserve Banking System. There are two types of Leases to keep in mind due to their dependence on the two concepts of Property-as-Wealth: “Kapital Leases” and “Operating Leases.”

An Operating Lease is essentially an agreement between the Lessor and the Lessee. The Lessor allows the Lessee to operate the building and the land. Neither the building nor the land is transferred to the Lessee. In exchange for allowing the Lessee to operate the building and land, the Lessor will charge Rent. For a privatized commercial firm, the Rents enable them to not record the land and buildings as Assets. The Rents will instead be treated as part of its own Expenses. What is said about buildings and land can also be said for anything that can be rented to a Lessee.

Note that anything under an Operating Lease is not owned by the Lessee. They are still the Private Property-as-Wealth of the Lessor. While the Lessee are immune to the costs and risks associated with ownership of Private Property-as-Wealth (those are the concern of the Lessor), they cannot claim tax cuts on any Depreciation from the Lease. Operating Leases are also temporary; at the end of the leasing period, the Lessee must either renew its Lease, return control of the buildings and land to the Lessor, or purchase them outright from the Lessor.

Conversely, a Kapital Lease has the Lessor transferring ownership of a Private Property-as-Wealth to the Lessee under the terms of an agreement. Ownership will be transferred at the end of the leasing period. But until that end of the leasing period, the Lessee is still required to pay Rent to the Lessor. In the accounting standards of the Liberal Capitalists throughout the Empire of Liberty, the following criteria must be met before a Kapital Lease could be arranged:

- The Lessor must agree to transfer their Private Property-as-Wealth to the Lessee.

- When the Lease begins, the Lessee must be allowed to bargain with Lessor to purchase the Private Property-as-Wealth at a Price lower than the one on the Real Estate Market.

- The Lease cannot be cancelled at any point in the leasing period.

- The Private Property-as-Wealth must retain at least seventy-five percent (75%) of its Value over the course of its Service Life.

- The Quantity of Kapital spent on the Rents associated with the Lease must exceed ninety percent (90%) of the Value of the Private Property-as-Wealth.

- The Lessee cannot redevelop the Private Property-as-Wealth to conduct another economic activity beyond whatever was intended by the Lessor at the end of the leasing period.

Purchase, Depreciate, Dispose, Repurchase

Land, buildings, vehicles, and equipment are affected by their own inherent Depreciation. Newly developed land, recently constructed buildings or manufactured vehicles and equipment are purchased at their original Price. Over the course of their Service Life, they will lose Value to the point of being only a fraction what it was worth. Past their Service Life, they become subject to “Disposition” or disposal.

An Accountant and Bookkeeper can monitor the Depreciation of land, buildings, vehicles, and equipment by tracking how much Value is being lost over the course of the Service Life. They would record them as Assets, recording how much Kapital was being spent to purchase them, how much was spent on their maintenance and repairs, and how much it could be sold when scrapped as the “Salvage Value.”

The Salvage Value represents how much Kapital could be generated from selling something at the end of its Service Life. A special equation is used to determine the Value of the disposal. Note that the Salvage Value will be less than the Value of what it was at the beginning of its Service Life.

Inventory Profitability

Aside from the Utility of land, buildings, vehicles, and equipment, there is the Profitability of finished goods stored inside the Inventory. Three methods gauging Profitability may be used by an Accountant to record the Quantity of Kapital. Each has its own set of advantages and disadvantages, all of which are dependent on the nature of a privatized commercial firm’s production process and transactional sales. They also rely on tracking Revenues from transactional sales, the Cost of Goods Sold (COGS), and the Profits.

The “First In, First Out (FIFO) Method” involves recording whatever was sold, used, or disposed of first by the privatized commercial firm. The oldest finished goods or whatever is past its Service Life will be prioritized before more recently produced finished goods or anything at the beginning of its Service Life. By focusing on whatever happens to be the oldest, the costs will be lower than their current Price under current Inflation/Deflation Rates, resulting in a Profit.

To further illustrate FIFO, imagine that it costs $75.00 USD to manufacture a widget in March 1999. That widget was stored in Inventory and later sold four months later at $120.00 USD. In July 1999, the cost of manufacturing the same widget was $81.00 USD. Since FIFO prioritizes the widgets manufactured in March 1999 over the ones made between April and July 1999, we can determine the Profitability by finding the difference of $120.00 USD and $75.00 USD to yield a Profit of $45.00 USD.

FIFO is best suited for smaller Economic Organizations that maintain smaller Inventories and are already employing the “Periodic Inventory” method. It is good for providing a more accurate Value of the Inventory as the COGS is lower. However, it causes increased Profits to be reported translating into increased taxation from Parliament because Inventory is considered an Asset.

The “Last In, First Out (LIFO) Method” differs by recording whatever was last sold, used, or disposed of by the privatized commercial firm. Here, the newest merchandise is prioritized over the oldest ones. Unlike FIFO, the Revenues and COGS are expected to be lower due to changes in the Inflation/Deflation Rate as well as any other costs associated with the production process.

For LIFO, recall that the Economic Organization had made widgets between March 1999 and July 1999. The ones manufactured in March 1999 cost $75.00 USD, the ones in July 1999 about $81.00 USD. A widget was sold for $120.00 USD in July 1999. LIFO prioritizes the inverse of FIFO: the one from July 1999 goes first, followed by the one from March 1999.

LIFO is ideal for larger Economic Organizations with larger Inventories and used in conjunction with the “Perpetual Inventory” method. While LIFO is designed to account for the Inflation/Deflation Rate, it is not great at determining the Value of the Inventory as the COGS tends to be higher, which results in lower Profits. This disadvantage is offset by decreased taxation from Parliament because Inventory is considered an Asset.

The difficult choice of deciding between LIFO and FIFO is not helped by the opportunity to use a third option, the “Weighted Average Cost Method.” It entails taking the quotient of the “Cost of Goods Available (COGA)” and the number of individual units of merchandise sold. It is only used to assign a Value to the cost of the Ending Inventory and the COGS. But unlike FIFO and LIFO, the Weighted Average Cost Method is not detailed enough to obtain an accurate picture of the Inventory and its Profitability, making it less reliable than FIFO and LIFO.

Categories: Work-Standard Accounting Practices

Leave a comment