We have previously discussed how Liabilities represent Quantities of Schuld an Economic Organization owes and Equities the Quantities of Kapital an Economic Organization earns. We even discussed how the Inventory, as Assets, has different ways of evaluating the Values of raw materials, finished goods, land, buildings, vehicles, and equipment. There are additional types of Liabilities and Equities which are relevant to Production for Profit/Utility. For the second half of this Entry, we will be exploring them in greater detail as potential weaknesses of Double-Entry Account Bookkeeping that can be exploited by the Work-Standard. The concepts described here derived from the various Entries that preceded it, plus those found in The Third Place (1st Ed.) and The Work-Standard (3rd Ed.).

To begin, imagine that there is an Economic Organization, a privatized commercial firm, operating in a Liberal Capitalist Parliamentary Democracy somewhere in the Empire of Liberty. The Economic Organization currently offers LCFIs (Liberal Capitalist Financial Instruments), namely Stocks, on the Financial Markets. There are Investors that have vested interested in the affairs of the Economic Organization. There are long-term payments to make after borrowing Kapital from privatized commercial banks with Interest. Parliament is expected to collect taxes from the Economic Organization. Hundreds of employees had formed a Labor Union to stage a strike, preventing anyone from crossing the picket line, demanding higher wages and assorted benefits.

These events and more are potential weaknesses of Double-Entry Account Bookkeeping. The Work-Standard can readily exploit them if one knows those weaknesses and where they occur.

Economism in Action

The employees of the Economic Organization are engaging in an act of what Vladimir Lenin had referred to as “Economism” in What is to be Done?. They are not serious about entertaining the realization of Pure Socialism, let alone Corporatism or Syndicalism. They just want to be paid more by their employer to make their lives under Neoliberalism a little easier. The corporate boardroom members, after some debating, have decided to negotiate with their employees’ Collective Bargaining arrangements. It is now up to the Accountant and the Bookkeeper to record the changes to the Quantity of Kapital allocated to the employees that succeeded in saving Neoliberalism from itself.

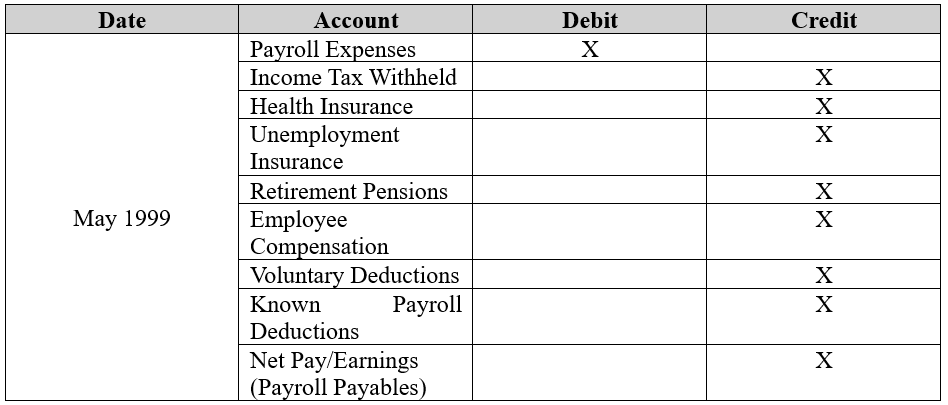

The “Payroll Payable” is a Liability describing how much Kapital is going toward the Wages or Salaries of its employees. It requires the following variables, all of which will be reported in the Daybook Journal entries, followed by those in the Financial Journal, before finally being included to the final total in the Balance Sheet:

- Gross Pay/Earnings: The Quantity of Kapital paid on an hourly, monthly, or annual basis.

- Income Tax Withheld: Parliament levies its Personal Income Taxes on each individual account based on the Quantity of Kapital. Tax Brackets are used to determine how much Parliament is capable of withholding as Tax Revenue.

- Health Insurance: How much Kapital was spent on any health insurance provided by the employer or by Parliament.

- Unemployment Insurance: How much Kapital was gained from filing for unemployment payments provided by Parliament.

- Retirement Pensions: How much Kapital was obtained from Pension Funds offered by the employer or Parliament.

- Employee Compensation: Any Kapital provided by the employers from Paid Time Off (PTO), Commission, Maternity Leave, Overtime Pay, or Bonus Pay.

- Voluntary Deductions: A Quantity of Kapital created from maintaining retirement savings accounts, payments to medical premiums, or donations to charities, philanthropic causes, or other Non-Profits. They can reduce how much Parliament can withhold in the forms of “Tax Credits” and “Tax Deductions.”

- Known Payroll Deductions: A Quantity of Schuld that automatically deducts Kapital if the employee in question fails to pay any taxes owed to Parliament. A “Wage Garnishment” is a well-known example a Payroll Deduction.

- Net Pay/Earnings: The Quantity of Kapital left over as the “take-home pay.” This represents the Kapital that the employee is free to spend for their own purposes.

These variables are represented in individual accounts, as evidenced by the following table. The Payroll Expenses is deducted from the Quantity of Kapital controlled by the Economic Organization. This fixed amount is allocated toward the other accounts as Accounts Payable.

Economic Organizations under Neoliberalism must spend Kapital on the Wages and Salaries of their employees. They are also required by Parliament to allocate Kapital toward additional expenses, such as the various Insurance, Pensions, and Compensations. Only the two Deductions genuinely impact the Private Citizen who is going to receive the Payroll. The Accountant is expected to account for the Kapital going to each Private Citizen employed at the Economic Organization, including whatever Kapital is going to Parliament as Personal Income Taxes.

One may even be tempted to assume that these Income Taxes, both Personal and Corporate, are why Liberal Capitalists tend to be particularly fond of fiddling with it. As Income Taxes have been a great way for Liberal Capitalist Nations to prop up their Military-Industrial Complexes since the two World Wars, it is not too much of a coincidence that their associated “tax cuts” coincide with rapid expansions of their Military-Industrial Complexes.

Parliament Passes Income Tax Cuts

Parliament levies various taxes throughout the Liberal Capitalist Nation. The most widely used tax since the turn of the 20th century is the “Income Tax,” conveniently providing Parliament with a lot of Kapital to finance its own purchases and expenditures. There is a “Personal Income Tax” for the Private Citizens of Civil Society and a “Corporate Income Tax” for all Economic Organizations operating in the Market of Civil Society. Around the same time as the Labor Strike was occurring, Members of Parliament (MPs) were debating on whether to cut Income Taxes.

- The Social-Democrat and Social Liberal MPs argued that the Payroll Taxes should be more progressive and thus more equitable for Civil Society. Why should the boardroom members of our Economic Organization be earning more than the employees who went on strike? Why should they not pay Income Taxes?

- The Classical and Economic Liberal MPs insisted that the Payroll Taxes should be lowered so that Civil Society can have more Kapital as Net Earnings/Pay. By giving Civil Society more Kapital, Parliament would gain additional avenues and opportunities to tax more Kapital out of Civil Society. There would be a “trickle-down effect” where employers such as our Economic Organization will be encouraged to expand existing economic activities.

- The Conservative and Christian Democrat MPs are roughly split between the Social-Democrats and the Liberal Democrats. Some agree with Social-Democrats, while others are aligned with the Liberal Democrats. The majority think that the Payroll Taxes should be reformed to benefit families, pensioners, and those engaged in the Public Sector.

If what I just described sounds familiar to anyone living in America, Europe, or any other Liberal Capitalist Parliamentary Democracy, that is because it has happened countless times since the Death of Bretton Woods. This is, or was, the metaphysical script behind how the various taxation reforms were articulated since the 1980s. By cutting Personal and Corporate Income Taxes, Parliament is basically encouraging other Economic Organizations and Private Citizens to spend more Kapital. In so doing, Parliament is expecting to collect Tax Revenue from other sources.

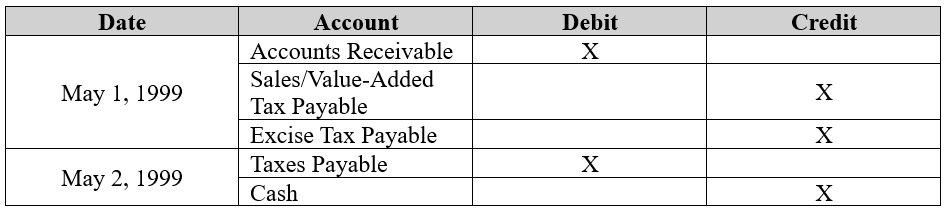

Suppose for a moment that a “Personal Income Tax Rate Cut” caused one of the employees at our own Economic Organization to buy a luxury item like jewelry. The jeweler, who operates their own privatized commercial firm, sold a diamond ring to one of our employees. An Accountant can record and track the payments from the employee to the jeweler. For ease of convenience, assume that the transactional sale occurred on May 1, 1999, and that the Tax Payables paid by the employees were later sent to Parliament on May 2, the following day.

Upcoming Payments to Bank Loans

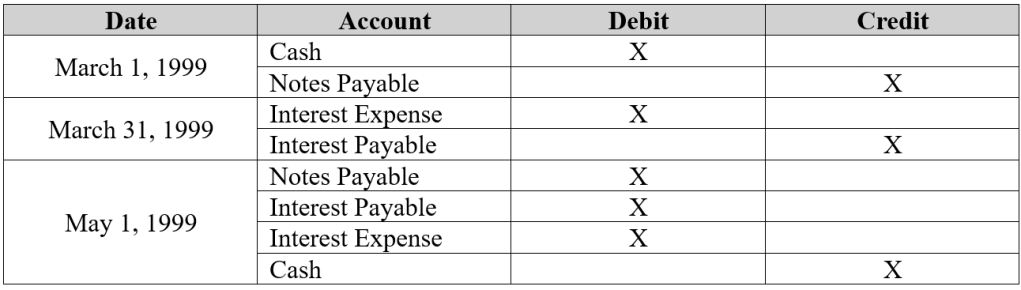

Up until now, I have been discussing Liabilities not covered in previous Entries. Those were the “Payroll Payables” and “Tax Payables.” The last Liability that deserves to be mentioned concerns our Economic Organization, in addition to the Corporate Income Tax Rate Cut, having borrowed some Kapital from a privatized commercial bank in the previous month. Obviously, the Tax Cuts and Profits alone are not going to sustain the required expansions to its operations. It still needed access to a ready source of Kapital from the Fractional-Reserve Banking System.

Here, an Accountant would record the Kapital borrowed from the Fractional-Reserve Banking System as a Liability known as “Notes Payable.” The Notes Payable represent the payments being made to pay back what was borrowed from the Fractional-Reserve Banking System. This also includes the “Interest Payable,” which is going to be treated as a given.

To determine how much Kapital needs to be paid for Interest, find the product of the Quantity of Kapital borrowed, the “Principal,” the Interest Rate (which is a percentage), and the “Maturity Term” (as the quotient of the days in a month and the days in a year).

The table below pertains to the details of the Loan, the Kapital allocated toward the Loan and the attached Interest Rate. The Notes Payable indicates the Quantity of Kapital that is needed to pay back what was borrowed as a Quantity of Schuld. Notice how the Interest payments recur monthly. The Economic Organization paid Interest for April 1999 and again in May 1999.

The Shareholders’ Confidence

In other Entries throughout this Section, it was established that Equity is the Quantity of Kapital invested into the Economic Organization, as well as its Revenues and Expenses. The Owner’s Equity is one such example that we discussed in an earlier Entry. It is now worth mentioning that another variation is the “Shareholders Equity,” which comes into effect with the trading of Stocks on the Financial Markets.

Stocks are a type of LCFI (Liberal Capitalist Financial Instrument) that enables an Investor to purchase a ‘share’ or ‘stake’ in the ownership of the Economic Organization that issues it. Purchasing the Stock enables an Investor to pour Kapital into the Economic Organization. Any increases or decreases to the Value of that Stock can be correlated back to the performance of the affected Economic Organization vis-à-vis Double-Entry Account Bookkeeping. From here, we can ascertain how well the Economic Organization according to how much Kapital it is willing to allocate to the Investors.

Our Economic Organization is no exception to countless other privatized commercial firms that are selling shares of ownership on the Financial Markets as Stocks. The actions of the Labor Union, the taxes passed by Parliament, and the Interest payments to the Fractional-Reserve Banking System can indirectly or directly impact Investor confidence. The Interest Rate, Income Tax Rate cuts, and Collective Bargaining of the Labor Union signal increases in both the “Consumer Spending” of Civil Society and its Private Citizens and the “Government Spending” of Parliament. While the increased expenditures will impact the Quantities of Schuld held by Civil Society and Parliament, certain Private Citizens stand to gain from the preceding sequence of events.

Anyone who buys the Stocks of our Economic Organization will receive a “Dividend” to either a monthly, quarterly, semi-annual, or annual basis. The Dividend represents a small sum of Kapital that encourages Investors to hold onto them rather than sell them whenever it becomes too profitable. An Accountant can discern these effects from the following series of equations.

The first equation is of course the Shareholders’ Equity for the Stock. It is the difference of the sum of the “Share Kapital” and “Retained Earnings” and the “Treasury Shares.”

The “Share Kapital” is the Quantity of Kapital already invested in the Economic Organization. It reflects the product of how many Stocks were issued to an Investor and their associated Values.

The “Retained Earnings” is another Quantity of Kapital, denoting how Kapital goes to the Investors as Equities and how much stays with the Economic Organization as Revenues. In essence, it is Kapital that has yet to be allocated to Investors as Dividends.

Lastly, the “Treasury Shares” or “Treasury Stock Shares” is a Quantity of Schuld that an Economic Organization sustains by engaging in buybacks of Stocks from Investors. As a Quantity of Schuld, it is always reported as a negative Value that diminishes the Values of the Share Kapital and the Retained Earnings.

Reported Weaknesses?

The weaknesses in question all allude to some aspect of Production for Profit/Utility. There are far more opportunities for any Economic Organization to generate more Schuld than Kapital within its own Balance Sheets. It will owe Kapital to Labor Unions, Parliament, the Fractional-Reserve Banking System, and the Investors. All four tend to separate entities unconnected and unrelated to each other in a Liberal Capitalist Parliamentary Democracy.

The Economic Organization needs ready access to Kapital from the Fractional-Reserve Banking System and from Investors interested in owning a portion of itself. It tolerates the Labor Union because they are not interested in upending the arrangements that are recorded by Double-Entry Account Bookkeeping. It turns to Lobbyists and Special Interest Groups to encourage Parliament to pass policies that benefit itself.

In most Liberal Capitalist Parliamentary Democracies throughout the Western world, the heart of the Empire of Liberty, the Taxes, Rents, Mortgages, and Interest are already burdensome for most Economic Organizations, regardless of their size, capabilities, Industry and Economic Sector. The high costs associated with tolerating the Labor Unions that operate on its premises is not encouraging. It is also true for high costs of insurance, pensions, compensation, and withholdings. Not to mention the abysmal returns allotted to the Investors, which tend to be significantly lower than the actual sum to purchase the Stock and acquire a single share.

If there were two recurring burdens on the economic activities of our Economic Organization, it would have to be Income Taxation, both Personal and Corporate, and the Interest Rate. Why bother with Income Taxation and Interest Rates when it has already been established in an earlier Treatise, The Work-Standard (3rd Ed.), that there will be no genuine need for either under the Work-Standard? After all, the State already has its own means of generating Revenues independent of Totality and Self. The same deserves to be said about Totality and Self as well.

Categories: Work-Standard Accounting Practices

Leave a comment