Back in Section One, we discussed how Receipts and Invoices operate under Double-Entry Account Bookkeeping. In their simplest forms, Receipts and Invoices are documented recordings of Kapital moving across different accounts and Schuld accumulating in others. Receipts are created by an Economic Organization whenever a transactional sale occurred, which involves the spending of Kapital and the receiving of a finished good or rendered service. Meanwhile, Invoices are created whenever a buyer or Customer decides to purchase something from an Economic Organization and plans to pay the Price in Kapital on a later date. As long as the Customer pays the Economic Organization the Kapital before the specified date on the Invoice, no Schuld will be created from that transactional sale. But if Schuld was indeed created by the Customer failing to pay back the Economic Organization past the specified date, the Economic Organization itself may be forced to pay the Schuld themselves.

The most distinguishing characteristic of Receipts and Invoices is that both presuppose that Kapital and Schuld are the variables being accounted for within any given transactional sale. In Double-Entry Account Bookkeeping, it is oftentimes assumed that there is Kapital and Schuld involved. Without Kapital and Schuld being the primary variables, all we have are just a bunch of meaningless numbers next to names and descriptions of items sold by an Economic Organization.

Therefore, under Command-Obedience Account Bookkeeping, we must always assume the key variables at play within every transactional sale are Arbeit and Geld. Remember, the production processes of goods and services and their subsequent transportation and distribution throughout the Tournament are not the only avenues where Arbeit is being converted into Geld vis-à-vis the Life-Energy Reserve. Transactional sales are the third major source of Arbeit-into-Geld.

Introduction to Scenario 1998

Let us begin by articulating a scenario worthy of being applied to every Entry in Section Three of this Treatise. A statistical sample of thirteen Enterprises are operating in the Germanic Planned/Command Economy, the sample representing a tiny sliver of its overall economic activities. There are three “State-Administrated Enterprises (SAEs),” three “State-Owned Enterprises (SOEs),” three “National-Socialized Enterprises (NSEs),” two “Public-Owned Enterprises (POEs),” and two “Public-Directed Enterprises (PDEs).” The five SAEs and SOEs are “State Enterprises,” the seven NSEs, POEs and PDEs are “Social Enterprises.” These twelve State and Social Enterprises are supported by two “Student Enterprises” from the Socialist Student Economy (SSE) and two “Digital Enterprises” from the National Intranet.

On an average day, all but three Enterprises are contributing Actual Arbeit to the Life-Energy Reserve, where it gets converted into Actual Geld. One Enterprise creates Military Arbeit due to its Domain falling under the Military-Industrial Complex, the other two contributing Digital Arbeit because they are primarily operating in the Digital Realm.

The smaller Social Enterprises get to keep the Actual Geld made from transactional sales, whereas the larger State Enterprises automatically transfer any Actual Geld from their transactional sales to the State Budget of the Council State. This arrangement was made possible by the conclusions made in the Entries of The Third Place (1st Ed.) and The Work-Standard (3rd Ed.). One aspect of the arrangement included the outlawing of Income Taxation, an emergency wartime taxation measure more suited for Production for Profit/Utility than the Production for Dasein under the Work-Standard.

The following table is a description of the State, Social, Student, and Digital Enterprises that will be frequently revisited throughout the rest of Section Three. Keep these names in mind because they will be invoked as we later begin to create other financial documents. Since the other aspects of their economic activities are covered in subsequent Entries, we will focus on the Actual Geld generated from their transactional sales.

| Enterprise | Enterprise Type | Account | Account Type | Obedience | Command |

| Adalbert Munitions | State-Administrated Enterprise | ||||

| Fogel Steelworks Concern | State-Administrated Enterprise | ||||

| Höbelheinrich Automotive | State-Administrated Enterprise | ||||

| Kroll Pharmaceutical Concern | State-Owned Enterprise | ||||

| Pantzer Mechanical Components | State-Owned Enterprise | ||||

| Liebezeit Electronic Components | State-Owned Enterprise | ||||

| Kolkmann Fabrics Consortium | National-Socialized Enterprise | ||||

| Fischöder Railway Consortium | National-Socialized Enterprise | ||||

| Leicht Department Store Consortium | National-Socialized Enterprise | ||||

| Meinholz Tailors Subsidiaries | Public-Owned Enterprise | ||||

| Biehr Apothecary Guild | Public-Owned Enterprise | ||||

| Freiman Groceries Guild | Public-Directed Enterprise | ||||

| Lehr Agricultural Subsidiaries | Public-Directed Enterprise | ||||

| Oberbröckling Gaming Studios | Student Enterprise | ||||

| Grupp Family Workshops | Student Enterprise | ||||

| Stumpf Website Developer Cooperative | Digital Enterprise | ||||

| Patzel & Schlegel Online Magazine | Digital Enterprise |

Documenting Transactional Sales: Receipts

Freiman Groceries is a Guild of PDEs selling grocery products to various towns and villages. Some of its products are supplied by Lehr Agricultural Subsidiaries, which is comprised of various farms, pastures, food processing factories, and slaughterhouses. In August 1998, one of the local branches of Freiman Groceries sold 70 GDM worth of items to a Customer. The Customer paid 70 GDM to Freiman Groceries before driving out of the parking lot in a gray Skoda sedan.

Of course, the Receipt should contain information pertaining to the date, the contact information and address of the local Freiman Groceries branch, descriptions of the items and how many were bought, the Prices for these individual items, and how the Customer paid for them. Note that, under the Work-Standard, there is no Sales Tax or Value-Added Tax for reasons that were addressed previously in The Work-Standard (3rd Ed.) and The Third Place (1st Ed.).

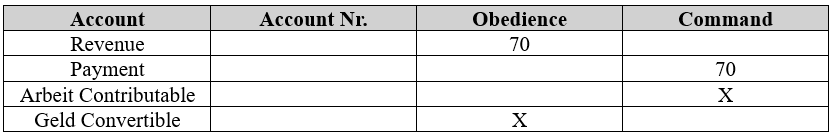

In any case, the Bookkeeper of this local Freiman Groceries branch also happens to be the Delegate of the Vocational Civil Servants employed at the Social Enterprise. While his subordinates are overseeing the Vocational Civil Servants at the registers and aisles, the Delegate is reporting financial data to the Accountant and the Economic Planner. The table below is the entry that the Accountant would later present to the Economic Planner regarding the aforementioned transactional sale:

From the table, we can ascertain the following information:

- Freiman Groceries received 70 GDM from a Customer.

- The Customer paid Freiman Groceries about 70 GDM.

- The success of the Transactional Sale yielded an unknown amount of Arbeit.

- When this unknown amount of Arbeit was converted at the Life-Energy Reserve, an equally unknown amount of Geld was the result.

It should be noted that the “Arbeit Contributable” and “Geld Convertible” are specific terms referring to the Life-Energization Reciprocity (LER) Process. After all, Freiman Groceries is registered to a specific Domain and is contributing Arbeit from its daily economic activities. These concepts deserve to be revisited in another Entry.

Documenting Transactional Sales: Invoices

Kolkmann Fabrics Consortium, which manufactures fabrics to produce clothing, received an Invoice the Meinholz Tailors Subsidiaries. The Leicht Department Store Consortium operates its branches across a handful of Shopping Citadels, its supplier being Meinholz Tailors Subsidiaries. The Leicht Department Store Consortium is planning to establish a new branch, but it is counting on Meinholz Tailors Subsidiaries to have various apparel items transported to the new branch a few hundred kilometers west.

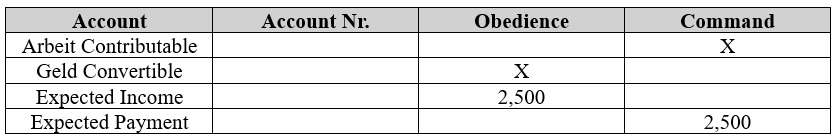

The Invoice was sent to Kolkmann Fabrics Consortium in July 1998. The new branch of Leicht Department Store Consortium is opening in October 1998, which means that Meinholz Tailors Subsidiaries has about two months to produce the requested clothing. Under Mission-Type Economic Planning (MTEP), the Accountant prepares a Direct Order for the Economic Planner to later issue to the Delegate and the Vocational Civil Servants at Kolkmann Fabrics. By October 1998, Kolkmann Fabrics will be expecting to receive 2,500 GDM from Meinholz Tailors. The Accountant’s entry of the ensuing economic activities are as follows:

We can make the following assumptions about the preceding table:

- Kolkmann Fabrics will contribute an unknown amount of Arbeit to the Life-Energy Reserve.

- An unknown amount of Geld will occur from the subsequent conversion of Arbeit.

- Meinholz Tailors is going to pay Kolkmann Fabrics 2,500 GDM to manufacture fabrics so it can create apparel for Leicht Department Store Consortium.

- Kolkmann Fabrics is expected to receive 2,500 GDM from Meinholz Tailors no later than November 1998.

Categories: Compendium, Work-Standard Accounting Practices

Leave a comment