The “Accounting Cycle,” as stipulated in The Work-Standard (3rd Ed.) and The Third Place (1st Ed.), is assumed to correspond to a predetermined Fiscal Year. In those Treatises, the general idea is that, at end of a given workweek, an Accountant would determine how much Arbeit and Geld contributed to the Life-Energy Reserve. This Arbeit and Geld correspond to the creation of new wealth in the LER and LERE Processes, rather than the mere transfer of existing Actual Geld between accounts as part of a transactional sale. The Economic Planner is expected to provide a copy of the Financial Ledger containing entries related to the LER and LERE Processes at the State Bank. The purpose is to allow the Central Bank to put additional Sociable Currencies into circulation because its ability to do so is limited by the overall Total Productive Potential (TPP).

The Economic Planner is still expected to deposit a copy of the Financial Ledger containing entries pertaining to the LER and LERE Processes at the State Bank. For the tangible transfer of existing Actual Geld from transactional sales, the Central Bank is already aware of the existing Actual Geld. What it needs to know is how much new Actual Geld was converted from the contribution of Actual Arbeit to the Life-Energy Reserve. These arrangements do affect the steps of the Accounting Cycle under the Work-Standard, which function differently in Command-Obedience Account Bookkeeping than they do in Double-Entry Account Bookkeeping.

Statement of Self-Reciprocation

This Diagram is a visualization of Arbeit-into-Geld and Geld-into-Arbeit. What the Economic Planner needs to disclose to the State Banks each workweek is the Arbeit-into-Geld. Any Actual Geld resulting from Geld-into-Arbeit can be reported later to the Inspector who periodically visits the Enterprise, verifying its finances for the Council State.

The Delegate of the Enterprise, in their official capacity as its Bookkeeper, will disclose all information pertaining to the production processes, transportation to and distribution at the Tournament, and the subsequent transactional sales to the Accountants. This information is provided to the Accountants by the Enterprise’s Delegate in a special financial journal called the “Statement of Self-Reciprocation (SSR).” An SSR contains entries pertaining to an Enterprise’s economic activities over the course of each workweek. Each SSR will feature two sets of entries: ones pertaining to the creation of new Arbeit and Geld, the rest on the movement of existing Actual Geld between the Enterprise’s accounts and accounts owned by others.

The first set of entries is needed by the Economic Planner, who is then tasked with reporting them to the State Banks at the end of the workweek. The other set of entries are kept by the Accountants and may be inspected by the Inspectors throughout the Fiscal Year. The first set of entries are referred to as “Arbeit-into-Geld,” the other set being “Geld-into-Arbeit.”

Such peculiar arrangements are of course related to the nature of the Work-Standard, which in turn is reflected in Command-Obedience Account Bookkeeping. They also impact how the steps of Accounting Cycle, how an Enterprise compiles its Financial Ledger, unfold.

Accounting Cycle Steps

- Find out all known sources of Arbeit and Geld from the Statement of Self-Reciprocation. There should be two sets of entries contained in the SSR. The Delegate is required to record information pertaining to the LER and LERE Processes as well as the transference of Actual Geld from transactional sales. The Accountants will need both sets of entries.

- Consolidate the SSR entries. Each entry in the SSR is a record of Arbeit contributed to the Life-Energy Reserve and Geld generated from transactional sales. Everything will be sorted in chronological order as they occurred throughout the workweek.

- Prepare the Unadjusted Trial Balance. The amounts of Arbeit and Geld are compiled into consolidated accounts. We will address them in later Entires throughout Section Three.

- Implement the “Convertibility Rate (CR).” The Convertibility Rate will be the entries used to make the necessary changes to the amounts of Arbeit and Geld. The goal is to account for whether any Arbeit was subject to a “Transvaluation of All Arbeit,” the effects of the “Mechanization Rate (MR),” “Attrition/Inaction Rate (AIR),” and whether any “Economic Socialization (ES)” occurred.

- The Accountant will search for any errors or discrepancies in the SSR. Once they are certain that everything appears to be in order, they will apply the CR to yield the Adjusted Trial Balance. The amounts recorded in the Adjusted Trial Balance will be the ones found in the Financial Ledger.

- The Accountant compiles three types of financial statements that are needed by the Economic Planner and can be inspected by the Inspector if necessary. Those are the Balance Sheet, Income Statement, and Workflow Statement. The Economic Planner already has the information to provide the State Banks.

- After determining all Revenues and Expenses and providing the three financial statements, the Accountant closes the Financial Ledger. The official “Worksheet of Sociable Accounts (WSA)” can then be assembled upon the closure of the Financial Ledger because the Central Bank will be putting additional units of Sociable Currency into circulation.

Everything up until this Entry in Section Three and everything after it shares the same purpose. The goal is to outline the procedures and parameters required to compile the WSA based on information from the Balance Sheet, Income Statement, and Workflow Statement. But those financial statements cannot be compiled without first understanding how the Financial Ledger is derived from entries found in the SSR. Thus, it is necessary to understand how the Bookkeeper relays information to the Accountants and how the Accountants themselves compile the information for the Economic Planner.

Compiling SSR and FL Entries with the X-Chart

In Command-Obedience Account Bookkeeping, all entries recorded in the SSR and Financial Ledger follow the same structure. They are arranged in a specific manner to properly process information in the accounts of the Worksheet of Sociable Accounts (WSA). Recall the following equation, which will be the one used to compile the WSA based on information from the three financial statements based on the Financial Ledger:

How does the Delegate document the economic activities of the Enterprise in the SSR for the Accountants? How do the Accountants compile the information from the SSR for the Financial Ledger? For both the SSR and the Financial Ledger, every entry contained therein is arranged according to the “X-Chart.” The X-Chart in Command-Obedience Account Bookkeeping is designed to track the occurrences of Arbeit-into-Geld and Geld-into-Arbeit. There is a “Command Side” and an “Obedience Side” showing how existing Actual Geld is transferred between accounts or how Actual Arbeit gets converted into Actual Geld in the case of the LER and LERE Processes.

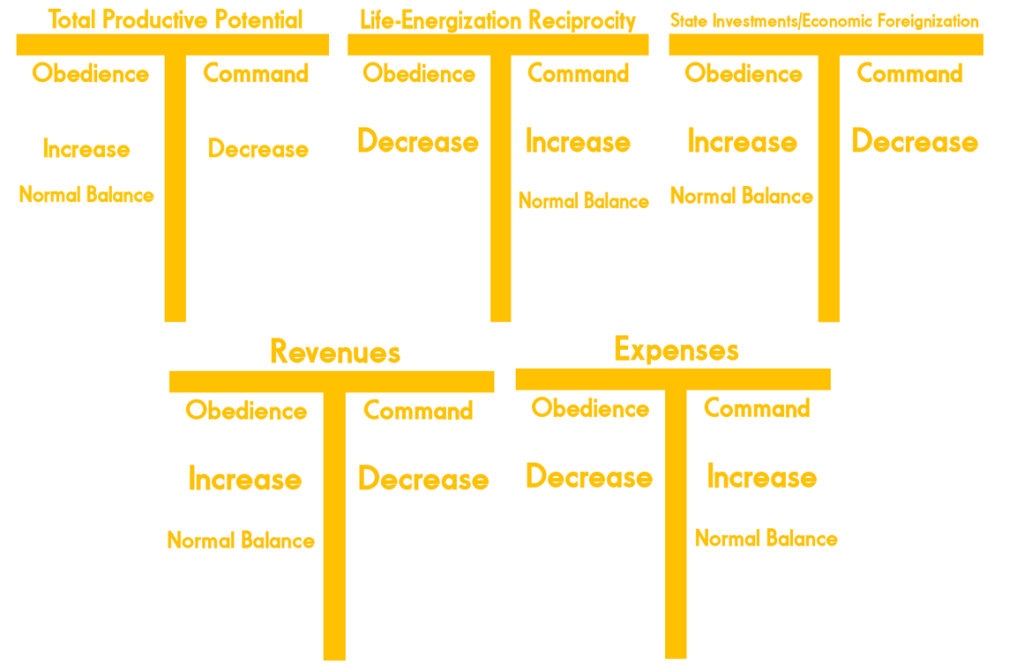

The X-Chart was designed in such a manner that the Obedience Side typically represents an increase to the balance of an account, such as those held by an Enterprise. Values entered on the Command Side denote any decreases to the same account. It will take some time to get used to them, but if it helps, I have assembled the following information for ease of reference:

- Increase TPP Accounts, SIEF Accounts, and Revenues on “Obedience Side.”

- Decrease TPP Accounts, SIEF Accounts and Revenues on “Command Side.”

- Increase LER Account and Expenses on “Command Side.”

- Decrease LER Accounts and Expenses are listed on “Obedience Side.”

Here are some examples of how entries are entered in the SSR and by extension the Financial Ledger. Suppose for a moment that a State Enterprise yielded generated 50 GDM in existing Geld from a transactional sale. An unknown amount of Arbeit was contributed to the Life-Energy Reserve and converted into additional Geld. This is the Quality of Arbeit (QW), which is in turn recorded in the SSR and Financial Ledger as the “Arbeit Contributable.” The resulting Quality of Geld (QM), the creation of new Geld converted from Arbeit, is recorded as the “Geld Convertible.”

For the sake of simplicity, we will assume that the Quality of Arbeit was 75 GDM and that the Quality of Geld was 150 GDM. To determine the State Revenue, we will take the Value of the transactional sale and the value of the Geld Convertible to yield a State Revenue of 200 GDM. Note that the final total should be “200 GDM” and not “275 GDM” because the Quality of Arbeit was already ‘converted’ into the Quality of Geld.

| Account | Type | Obedience | Command |

| Sales | LER | 50 | |

| Arbeit Contributable | LER | 75 | |

| Geld Convertible | LER | 150 | |

| State Revenue | TPP | 200 | |

| Accounts Receivable | TPP | 200 |

However, in actual practice, it is possible for the WSA’s LER Account to contain Arbeit that has not yet been converted into Geld. Any Arbeit not yet converted into Geld will be reflected as the Total Economic Potential (TEP); Arbeit that did get converted is added toward the Total Financial Potential (TFP). This can be demonstrated in the SSR and later reflected in the Financial Ledger.

| Date | Account | Type | Obedience | Command |

| July 1998 | Sales | LER | 50 | |

| July 1998 | Arbeit Contributable | LER | 75 | |

| July 1998 | State Revenue | TPP | 125 | |

| July 1998 | Accounts Receivable | TPP | 125 | |

| August 1998 | Geld Convertible | LER | 150 | |

| August 1998 | Convertibility Rate | LER | 75 | |

| August 1998 | State Revenue | TPP | 200 | |

| August 1998 | Accounts Receivable | TPP | 200 |

The above table shows that in July 1998, a State Enterprise generated 50 GDM from a transactional sale, of which 75 GDM was created and contributed to the Life-Energy Reserve. On this month alone, the State Enterprise reported a State Revenue of 125 GDM. However, the Central Bank did not decide to convert the Arbeit into Geld until the following month. After the Arbeit was converted into Geld in August 1998, the Convertibility Rate was employed to adjust the amounts. Without any usage of the Convertibility Rate, an incorrect amount of 275 GDM would be the result.

There are plenty of other accounts that can be recorded in the SSR and Financial Ledger. While some of them are known to appear in the WSA, some do not appear there. They can, however, be found in the Balance Sheet and corroborated by the Income Statement and Workflow Statement.

Categories: Compendium, Work-Standard Accounting Practices

Leave a comment