To all Readers of The Fourth Estate,

I have decided to resume writing for The Fourth Estate on WordPress, abandoning its Substack extension for the very simple fact that it is no longer necessary for me to ever charge even $0.01 USD for a Monthly Subscription, to read my writings, or both. No matter where I go on Substack, on YouTube or wherever, I always come across the Digital Realm’s equivalent of “living off the kindness of strangers.” I myself almost decided to jump on that bandwagon just to ensure that The Fourth Estate on WordPress will be able to sustain itself financially.

Today, I am proud to announce that I will never charge anything for anyone who reads The Fourth Estate. Whatever I write on this Blog should always be free to read.

For nearly a year, I made the conscious and deliberate decision to participate in the Financial Markets as a sort of “State Capitalist.” The Intent was and continues to be financing the Blog so that it will not only pay for itself, but also be able to propagate its existence. Autarky–“Financial Autarky”–has consistently been an ideological principle of mine.

As I pointed out in The Work-Standard, with so many choices and avenues available to take on the Financial Markets, it is no wonder why most people either lose, break even, or simply do not participate at all. I have long suspected for years that there have to be ways to generate income from the Financial Markets on a weekly basis. In return for swearing a sort of oath of allegiance to something (through recurrent investments and refusals to sell out), the loyalty is duly rewarded in kind every Friday morning. At the same time, I also bear the Command Responsibility of ensuring that enough “Unrealized Gains” are amassed to soak up whatever losses may incur from continuing to uphold that oath of allegiance.

With investments in stable, high growth-oriented Stocks, the next logical steps are to invest in a number of ETFs that pay Dividends either every Friday morning or according to a predetermined Schedule. Of course, the Dividends are going to vary from last Friday morning, this coming Friday morning, and the next Friday morning. The fact that such consistent payments could be synchronized to the hands on a pocket watch or wristwatch should not be ignored.

As to which ETFs are these, I am of course referring to the ones maintained by the following four investment firms:

- Defiance

- Rex

- Roundhill

- Yieldmax

Some of the ETFs offered by the aforementioned fall within my investment goals: the ability to obtain bulk shares that oscillate across a given range (typically $11.00-$16.00, $20.00-$25.00, $40.00-$50.00); pays each Friday morning in cash; provide limited exposure to specific Stocks; and are partially backed by Interest accrued from US Treasurys as collateral. The most important consideration is whether it thrives off of any uncertainty or turmoil on the Financial Markets.

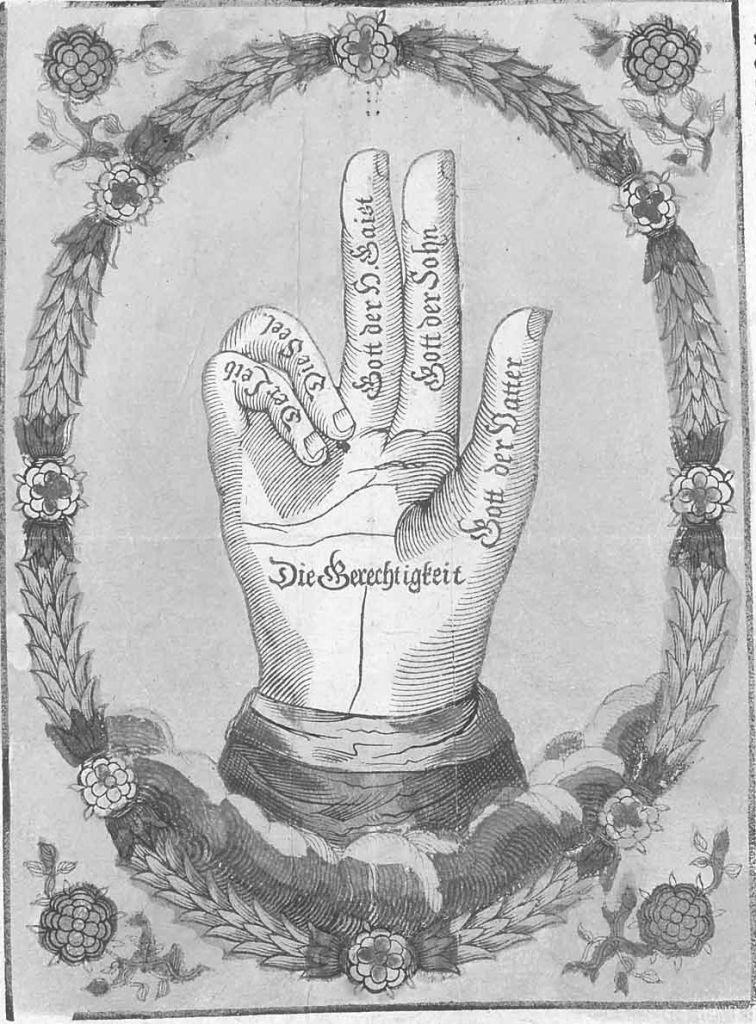

For more than two months, I have been observing the performance of a number of ETFs to form a “Schwurhand.” The strategy has been working and I am amazed at 10% increase in the Returns on Investment.

The Schwurhand Strategy is pretty straightforward: At least three fifths of the Shares have to do well on any given month, with any losses incurred by the other two fifths are absorbed by the Unrealized Gains. Since any Unrealized Gains do not count as money that I can readily spend or reinvest until I sell, I end up walking away with a steady stream of income.

With 2024 almost over, I am being presented with a rare opportunity: should I use the newfound income for personal everyday spending, reinvest them elsewhere, consolidate existing positions, or acquire an AI software program to help me implement a Financial Schwerpunkt? The AI software will enable me to establish new positions with the position to increase the number of losses that the Portfolio can soak up on in a given week or month. Higher Unrealized Gains means having more room for errors that I can eventually correct once Prices fall within an optimal range. Higher Dividend Payouts will translate into more resources toward the Financial Schwerpunkt, The Fourth Estate, and personal spending.

Sincerely,

-Duty and Honor

Categories: Blog Post

Leave a comment