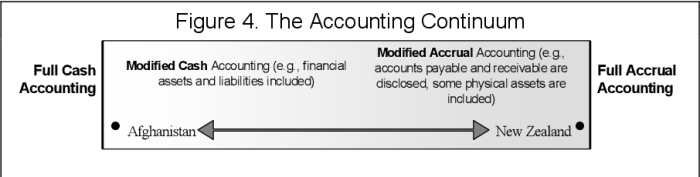

In “The Cash and Accrual Methods” and “The Modified Accrual Method” Entries from Section One, I discussed about the most prominent accounting techniques employed under Neoliberalism in both Production for Profit and Production for Utility. The Cash-Basis Method only provides information about how many Quantities of Kapital and Schuld that a privatized commercial firm earns at present. The Full-Accrual Method also tracks the Quantities of Kapital and Schuld, but does so on any given timeframe, which affects precisely when Revenues and Expenses are recorded.

One should recall that most Parliaments and economic organizations under Liberal Capitalism use the Full-Accrual Method, which is enforced by the “financial obligations” that are required of everyone involved in any given economic activity. What deserves to be mentioned here is that the Full-Accrual Method’s worldwide adoption coincided with the Death of Bretton Woods, the rise of Globalization, Financialization and Deindustrialization, and the emergences of Financial Technologies employed by the Fractional-Reserve Banking System.

Bluntly speaking, the Full-Accrual Method is employed in conjunction with the Fractional-Reserve Banking System. Its widespread usage was made possible by the fact that Liberal Capitalist regimes are now able to marshal immense sums of Kapital in exchange for equally large sums of Schuld. Since Parliament, Civil Society, and the Private Citizen are now able to borrow more Kapital than what was previously possible during Bretton Woods and the British Empire’s Gold Standard, the Full-Accrual Method enables accountants to process and track the long-term movements of Kapital and Schuld between Fractional-Reserve Banking System on the one hand and Parliament and Civil Society on the other.

The trend itself is made discernible from the name itself. the “accrual” obviously refers to the Kapital Accumulation that occurs from maintaining the balance between Kapital and Schuld. As one might surmise from the increased borrowing and lending, today’s Parliaments, Civil Societies, and Private Citizens are now saddled with more Schuld than they were in the 20th century. Nobody knows just how much Schuld the Fractional-Reserve Banking System is capable of sustaining, but what can be said is that there are genuine limitations that manifest from the State of Total Mobilization itself. The environmental degradation, the resource depletion, and the implications of Climate Change are three notable indicators which the Fractional-Reserve Banking System is incapable of recording. Environmentalists are aware of this, but it is not like the entire Accounting Profession worldwide is fully aware of those implications.

The Work-Standard’s equivalents in NSAP are, of course, the “Life-Energization Basis Method (LEBM)” and the “National-Socialized Basis Method (NSBM)” Techniques. The criteria that compelled the creation of both Techniques, not to mention their inclusion so late in Section Three, were based on the following conclusions from an earlier Entry, “Key Accounting Assumptions and Principles of NSAP”:

- All sources of Actual Arbeit and Geld from the LER Processes need to be registered in real-time as they occur. They need to be recorded alongside any concurring generations of Actual Geld from transactional sales.

- All sources of Digital Arbeit and Geld from the LERE Process are registered as they occur. The same is to be said for Military Arbeit and Geld from the Military-Industrial Complex.

- Any Actual Geld allocated from the Council State and the Kontore can be processed and readily deployed by State, Social, Student, and Digital Enterprises.

- They can facilitate Trial Balancing by means of the Convertibility Rate (CR) and the Transvaluation of All Arbeit, where the Accounts Reconcilable and Accounts Transvaluable are employed to record changes to the Qualities of Arbeit and Geld within the LER and LERE Processes in response to the Attrition/Inaction Rate (AIR).

- The need to record and process a large variety of different transactional sales, the contributions of different types of Arbeit and Geld from multiple sources, and the ability to do so across various locations both inside and outside the Nation. The obvious purpose is to accommodate the Economic Socialization (ES) and Solidarity Rate (SR).

- Everything discussed must be compatible with the Worksheet of Sociable Accounts, to be used by Accountants working under Economic Planners within everyday applications of Mission-Type Economic Planning (MTEP).

- Finally, an Accountant must be able to discern the Presence-at-Hand and Readiness/Unreadiness-to-Hand concepts of Production for Dasein as part of MTEP. Just as the Economic Planners are expected to be familiarized with them, so too should the Accountants and any Bookkeepers under their Command Responsibilities.

As stipulated earlier, the LEBM and NSBM were devised to fulfill aspects of those criteria. One may be forgiven for assuming that there are little differences between the two. In actuality, however, there are fundamental differences which deserve mention in anticipation of devising the financial statements of an Economic Organization at the end of Section Three. Over the next two Entries, I will be demonstrating how they function and where they become practical by dint of Reference and Relevance within Production for Dasein.

Categories: Compendium, Work-Standard Accounting Practices

Leave a comment